charitable gift annuity administration

Maintain complete accurate and confidential records for donors and other annuitants. The Board of Directors of the ACGA met on May 17 2022 and voted to increase the rate of return assumption we use when suggesting.

Abcs Of Cgas Basics Of Charitable Gift Annuities Gordon Fischer Law Firm

FASB 116 and 117.

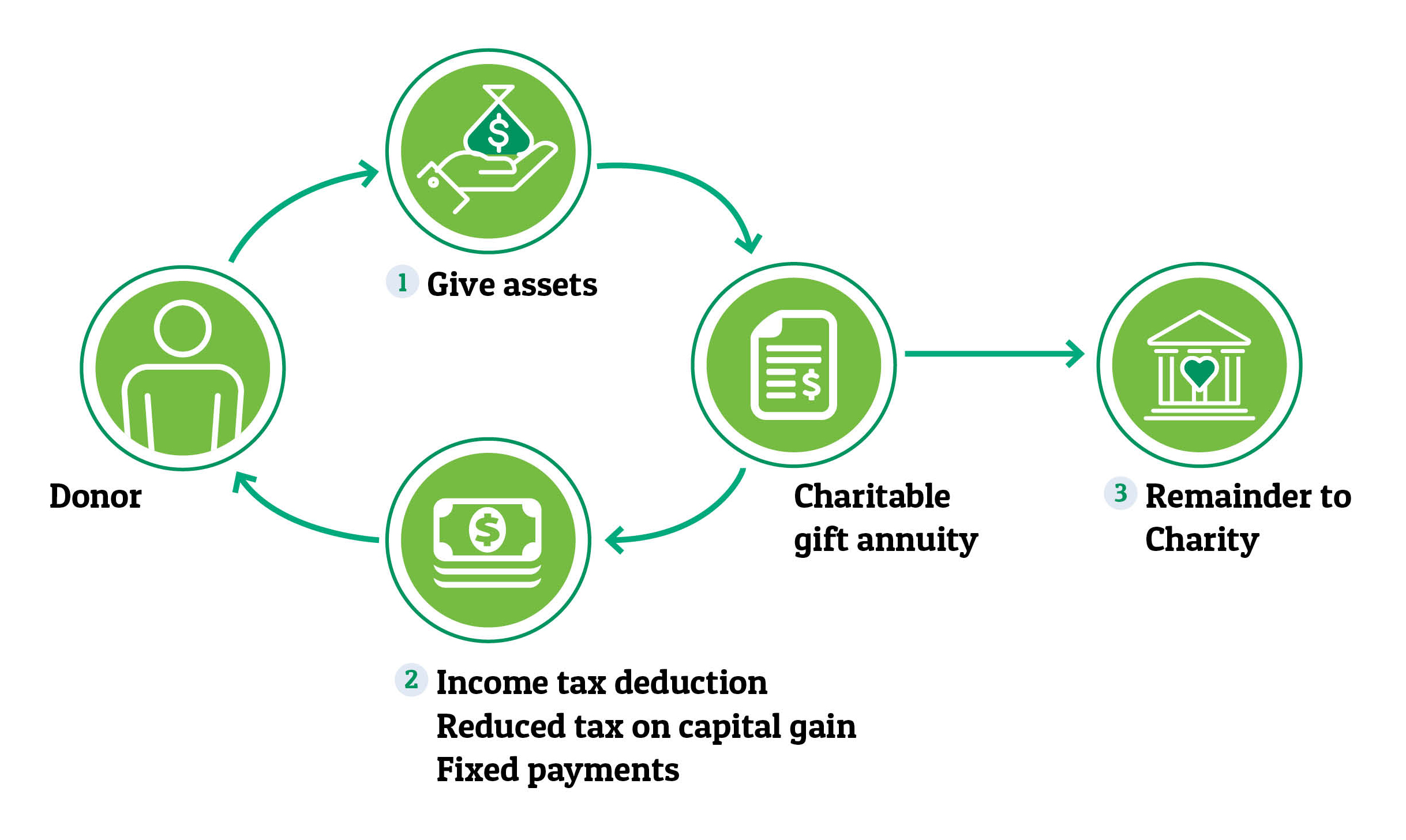

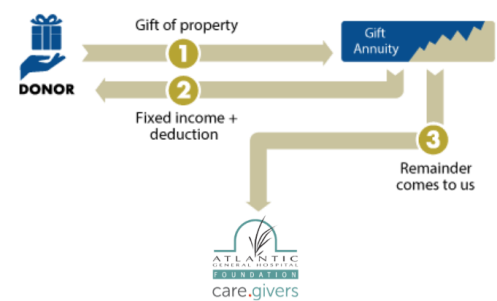

. Charitable gift annuity reinsurance is simply a financing technique whereby a charity chooses to purchase a commercial single premium immediate annuity either an individual or group. When used effectively consulting services can save a charity both time and money. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non.

We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity. Testamentary charitable gifts of savings bonds and commercial annuities may provide a more favorable outcome. Charitable Solutions LLC is a planned giving risk management consulting firm.

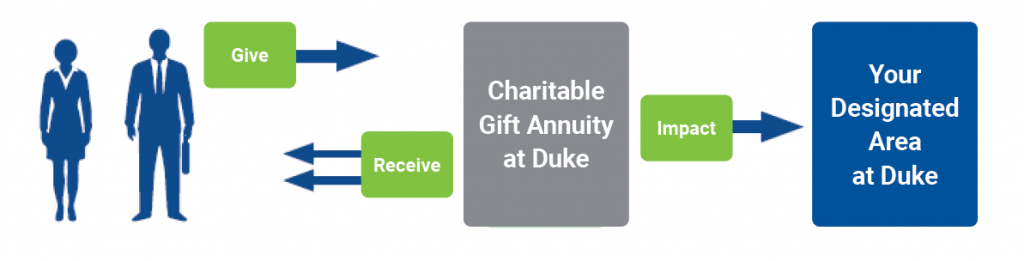

A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to a charity and the charity gives back an agreed-upon income stream to the donor for the. In exchange for a gift of assets ie cash stock bonds real estate etc the. We assist with everything from initial.

Complete all CGA administration reports. 133 rows Rates Announcement - 6222. We assist in determining an organizations readiness and potential suitability for launching a charitable gift annuity program.

Most estates will not be subject to the estate tax because. Toapply for a special permit to issue charitable gift annuities. The base WatersEdge administration fee is 105.

For the testamentary CGA. The charitable deduction would be the excess of the funding amount of the CGA over the present value of the annuity the value to the annuitant. We currently administer over 150 charitable remainder trusts and 600 charitable gift annuity contracts.

The surveys include questions related to. Send a cover letter there is no formal application form along with the materials requested. Preserves the value of highly appreciated assets.

A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. There is an additional fee of 50 for charitable gift annuities and its proceeds fund an annuity reserve fund that guarantees.

A Charitable Gift Annuity is a contract between a donor and National Catholic Community Foundation that provides a lifetime of annuity payments to the donor and survivor or other. The gift annuity surveys conducted by the ACGA are the best source of information about charitable gift annuity policies practices and trends. In exchange for a gift of assets ie cash stock bonds real estate etc the.

Charitable Gift Annuities Bryn Mawr College

American Council On Gift Annuities Smyrna Ga Facebook

The Pros And Cons Of Charitable Gift Annuities

The Gift That Pays You Income Diocese Of Sioux City Sioux City Ia

Free Download How To Let Your Donors Know About The New Charitable Gift Annuity Rates

Charitable Gift Annuities Kqed

Is It Worth Starting A Charitable Gift Annuity Program Cck Bequest

Planned Gift Administration Pg Calc

Specimen Agreements Charitable Gift Annuity Planned Giving Resources Coursera

Simple Steps To Start And Grow A Gift Annuity Program

Planning Your Legacy Atlantic General Hospital In Berlin Md

4 Long Term Ways To Give To Charity Capstone Financial Advisors

8 Introduction To Charitable Gift Annuities Part 2 Of 3 Planned Giving Design Center

Charitable Gift Annuities Uses Selling Regulations

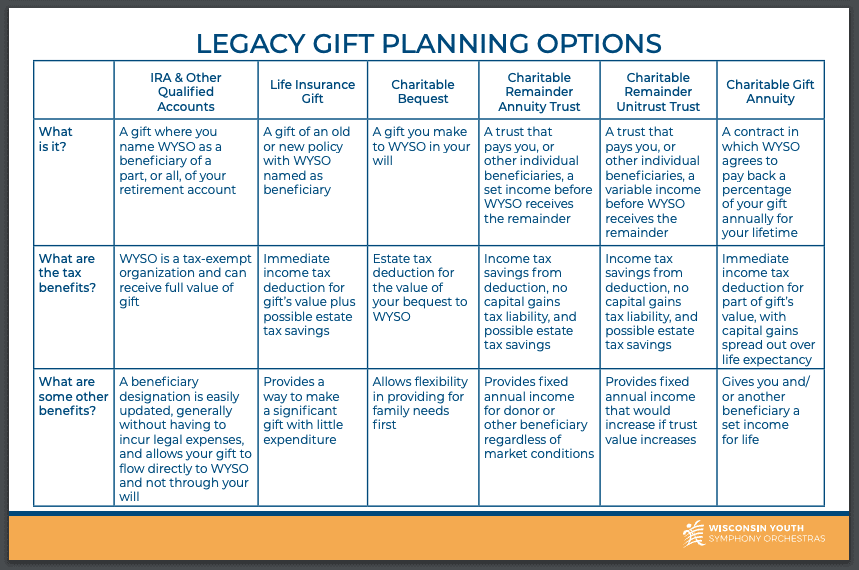

Wyso Legacy Giving Wyso Wisconsin Youth Symphony Orchestras